INDEPENDENT LNG & TRANSITIONAL ENERGY INFRASTRUCTURE PLATFORM

Millennium Energy Partners is a principal LNG infrastructure and commercial execution platform operating at the intersection of Tier-1 portfolio supply, structured credit, and LNG-to-power development.

The firm originates LNG demand with utilities, infrastructure sponsors, and industrial buyers, aligning international portfolio suppliers and confirming banks to execute bankable back-to-back and long-term supply frameworks.

Millennium engages at project conception — advising on fuel strategy, terminal configuration, and credit structuring — and leads the commercial architecture of phased LNG supply programs integrating LC-based trade finance and long-term fuel strategy within large-scale power generation and energy infrastructure projects.

The platform emphasizes disciplined execution, credit alignment, and repeatable supply programs progressing from validation cargoes to scalable, long-term contracted volumes.

LNG SUPPLY & EXECUTION STRATEGY

The LNG supply strategy is built around phased execution rather than speculative volume commitments.

Initial transactions are structured as validation or trial cargoes, allowing counterparties to confirm logistics, specifications, delivery performance, and settlement mechanics in a controlled manner. Subject to successful execution, volumes may scale into repeat deliveries and, where appropriate, longer-term supply arrangements.

Binding purchase and sale commitments are entered into only following full counterparty onboarding, credit confirmation, and successful execution validation.

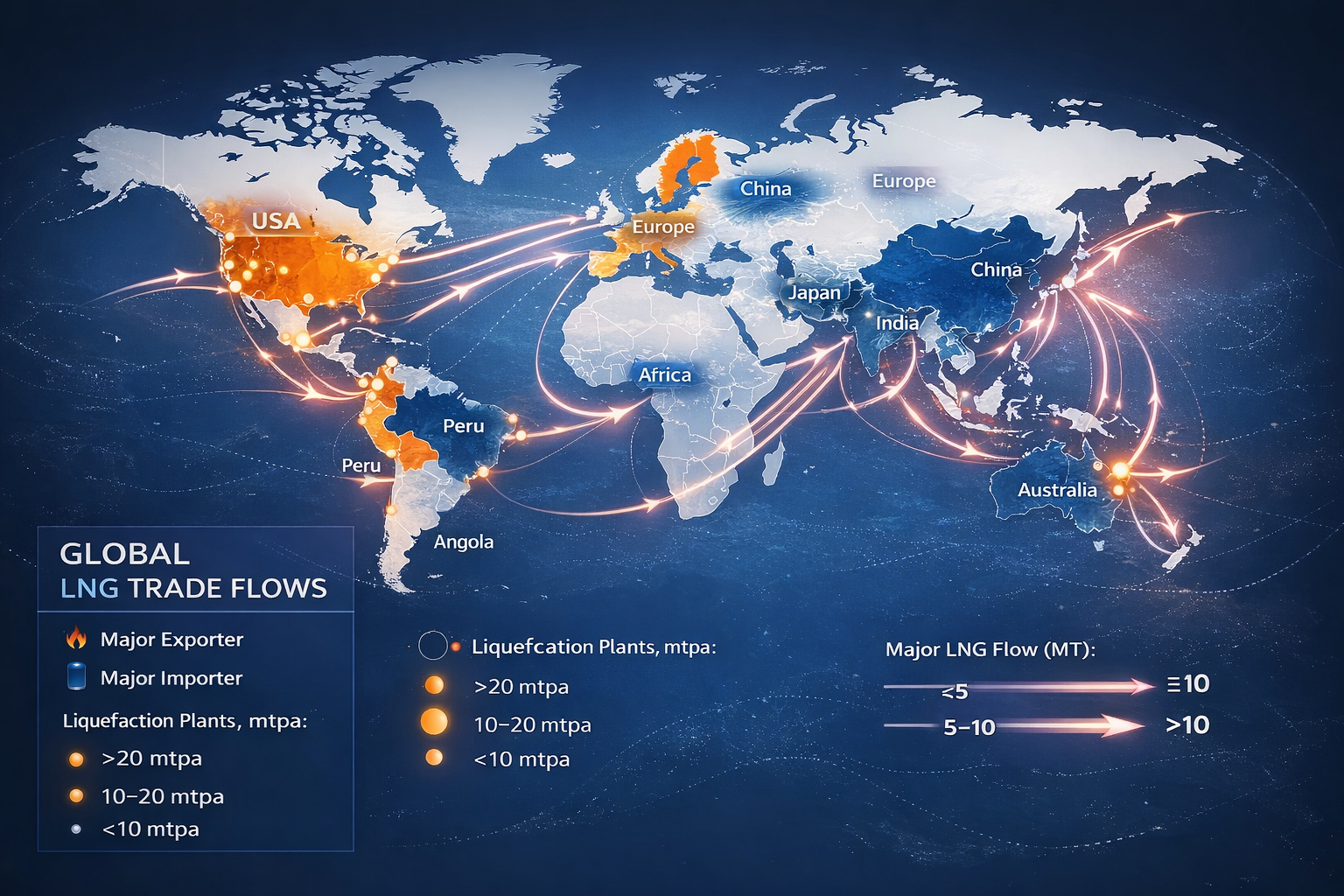

Supply is sourced from nominated portfolio suppliers and established market counterparties under flexible delivery terms, including DES, DAP, or CIF structures, depending on terminal configuration and buyer preference. This approach reflects prevailing LNG market practice across Asia, Europe, and other importing regions.

The role is execution-led and structure-focused, emphasizing coordination, readiness, and delivery discipline rather than proprietary or speculative commodity trading.

WORLD CLASS EXPERTISE

MEP is led by senior energy infrastructure executives with over two decades of experience delivering natural gas, LNG, power generation, and transitional energy projects across global markets.

The leadership team brings deep, hands-on experience across the full project lifecycle — including origination, permitting, commercial structuring, financing, engineering coordination, construction oversight, and operational execution.

This experience spans LNG supply chains, gas-fired power generation, and associated infrastructure, with successful transactions and deployments across Europe, Asia, and other importing regions.

MEP’s leadership approach is execution-led and continuity-driven, aligning long-term counterparties, infrastructure owners, and suppliers through disciplined structuring and delivery-focused governance.

ENERGY TRANSITION SOLUTIONS

MEP focuses on energy infrastructure solutions designed for long-term sustainability and adaptability. Projects are structured to support cleaner-burning natural gas and LNG today, while maintaining technical and commercial optionality for future transition pathways, including hydrogen and other lower-carbon fuels where appropriate.

MEP’s approach emphasizes infrastructure durability, operational efficiency, and scalability, ensuring assets remain viable across evolving regulatory, environmental, and market conditions. Transition readiness is integrated through disciplined design, supply structuring, and execution planning, rather than speculative technology or fuel assumptions.

Where relevant, projects are structured to align with prevailing ESG and emissions-management frameworks required by lenders, regulators, and counterparties, supporting bankability and long-term asset resilience.